Description

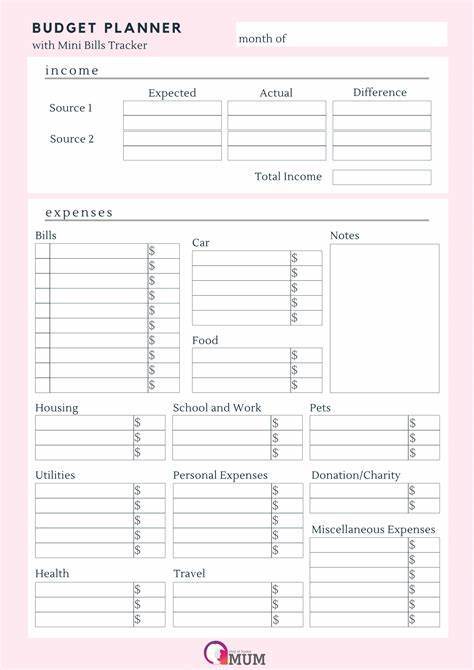

Introducing our Budget Planner – your comprehensive tool for taking control of your finances, achieving your financial goals, and building a secure future. More than just a spreadsheet or a list of expenses, it’s a strategic roadmap that empowers you to make informed decisions, prioritize spending, and track your progress with confidence and clarity.

In today’s complex financial landscape, managing money can feel overwhelming. From monthly bills to savings goals to unexpected expenses, it’s easy to lose sight of where your money is going and how it’s being used. That’s where our Budget Planner comes in. With its intuitive layout and user-friendly design, it provides a holistic view of your financial picture, allowing you to plan ahead, identify areas for improvement, and make adjustments as needed.

Key features include:

- Income and Expense Tracking: Keep tabs on your income sources and track your expenses with ease using our Budget Planner’s dedicated categories and customizable fields. Whether it’s rent, groceries, utilities, or entertainment, you’ll have a clear understanding of where your money is being spent.

- Budget Allocation: Set realistic budgets for each spending category based on your income and financial goals. Our Budget Planner helps you allocate funds strategically, ensuring that you’re spending within your means and prioritizing your most important expenses.

- Savings Goals: Establish savings goals for short-term needs (like a vacation or a new gadget) and long-term objectives (such as a down payment on a house or retirement savings). Track your progress over time and celebrate milestones as you work towards achieving financial security.

- Debt Management: Keep tabs on your outstanding debts, including credit card balances, loans, and other liabilities. Develop a plan for paying down debt strategically, whether it’s through snowball or avalanche methods, and monitor your progress as you work towards financial freedom.

- Financial Planning Tools: Access a range of financial planning tools and resources to help you make informed decisions about your money. From retirement calculators to investment guides to tax planning strategies, our Budget Planner equips you with the knowledge and tools you need to build a strong financial foundation.

- Expense Analysis: Analyze your spending habits and identify areas where you can cut back or reallocate funds to better align with your priorities. Our Budget Planner’s built-in analytics tools provide valuable insights into your financial behavior, empowering you to make smarter choices about how you use your money.

- Security and Privacy: Rest assured that your financial information is safe and secure with our Budget Planner’s robust security measures and encryption protocols. Your privacy is our top priority, and we take every precaution to protect your sensitive data.

With our Budget Planner as your trusted companion, you’ll gain confidence, clarity, and peace of mind in your financial journey. Say goodbye to financial stress and uncertainty – and hello to empowerment, control, and financial well-being. Start your journey towards financial freedom today with our Budget Planner – your key to a brighter, more prosperous future.

Nicholas –

As someone who used to dread budgeting, this planner has made the process surprisingly enjoyable. Its user-friendly layout and intuitive design make it easy to track income, expenses, and savings goals. I appreciate the flexibility it offers to customize categories and adjust our budget as needed. Plus, the motivational quotes sprinkled throughout keep me inspired and focused on our financial journey.

Ukamaka –

This budget planner has been a game-changer for me and my family. It’s helped us get our finances in order and work towards our financial goals with clarity and purpose. I love how it breaks down our budget into manageable categories and prompts us to set realistic spending limits. The additional sections for tracking savings and debt repayment have been incredibly motivating.

Imaobong –

I’ve tried various budget planners, but this one stands out as the best by far. Its comprehensive layout covers everything from income and expenses to savings goals and debt repayment plans. I appreciate how it helps me track my spending and stay on budget each month. Plus, the visual graphs and charts make it easy to see where my money is going and identify areas for improvement.